Second hand used cars are becoming very popular in today’s market. Customers want to utilize their money wisely, and hence going for a well- maintained second-hand vehicle. You can easily purchase a better variant of the same model if you choose to buy a second hand used car. Since this market is enormous, you must be careful while taking any big step. You must look for trusted dealerships like Maruti Suzuki True Value and buy the certified second hand models. These dealers will also help in arranging loan and financing your purchase. Here we have listed some of the ways to arrange loans and finance options for buying a second hand used car.

Banks will give loans for your second hand car

Yes, you heard it right. It is a misconception that banks give loans only for buying a brand new car. Since the used car market is rapidly growing, the banks nowadays show interest in providing loans to the customers for purchasing a second hand car. The banks are only concerned that the buyers must be careful while choosing the dealers. A well-trusted dealer will respect all the terms and conditions of the bank. Hence the bank will also help the customers in their purchase.

Contact the dealership for arranging loans

Some of the best dealerships, like Maruti Suzuki True Value, are capable of arranging the loans and finance for your second hand used car. The banks also love working with these trusted dealerships. If you choose to finance your purchase through the dealers, it is also possible you get the loan at lower interest rates. Also, there are many year-round offers which you can combine to get the best deal. If you own a car, and you want to sell it, you can connect it too, and hence get a lower price for your contract.

Buy a used car through credit card EMI

It entirely depends on the limit of your credit card and your credit score. You must have a good credit score to buy the used car. You can purchase the refurbished car by paying an entire amount through your credit card. Credit card companies allow you to carry out such transactions and payback through EMIs. Different companies have variable EMI plans. You must go for the best one which suits your need.

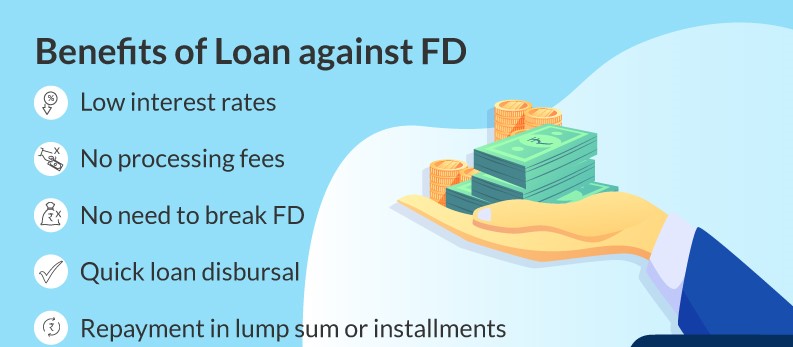

Get a loan against your fixed deposit

It is the last option you must consider. Many banks and other Non-Banking Financial Companies( NBFC) provide you loan against your solid collateral. You need not to break your fixed deposit. The banks and other NBFCs will help you in buying your second hand used car. In return, you must return the appropriate decided amount to them in fixed time.

Nowadays, taking a loan and choosing finance options is a very smooth process. All the steps involved are safe and secure. These banks and Non-Banking Financial Services offer a wide variety of schemes to choose from. You must be smart and careful enough to select the best offer for you. Some of the NBFCs include Reliance, Kotak, Mahindra, etc. Also, both private, as well as public sector banks, provide loans for purchasing second hand used cars